RBI today stuck to its tightening stance and hiked the Repo rate from 8.5% to 9%

It also tinkered with the CRR, hiking it by 25 bps from 8.75% to 9%.

Repo rate essentially forms the upper ceiling of the Liquidity adjustment Facility and constitutes the rate at which RBI would be willing to lend funds to banks .In short, it is the rate at which RBI injects liquidity into the system.

Given a background of tight liquidity as evidenced by virtually no bids on the Reverse Repo window, call rates close to 9% and inflation just a tad below 12%, this move of the central bank to further increase borrowing costs of banks can be seen as a measure to restrict the lending capacity of banks and thereby rein in credit off take.

CRR on the other hand measures the ratio of time and demand deposits that banks would compulsorily need to park with the Central bank. A hike in the Reserve requirements would affect the potential of the banking system to create transaction deposits thereby resulting in reduced money creation and, in turn, in reduced economic activity.

While seen as an effort to preempt any further build up of inflationary pressures, the above increases would have the effect of pressuring profit margins of banks and slowing growth in the forthcoming quarters.

Generally when the key monetary variables are raised, it has the effect of increasing forward premiums from the following standpoints:

- interest rate differential between US and India widens in favour of the latter and therefore the former nation’s (US) currency tends to gain in the forward market to eliminate any interest rate arbitrage today.

- Domestic bond yields rises which gets reflected in the forward premia.

- Banks in order to meet the increased margin requirements will need to attract more deposits - a proposition that is difficult in the very near term .Therefore banks tend to indulge in sell-buy swaps in the foreign exchange market wherein they sell dollars in the spot market and take an offsetting position by buying dollars in the forward market to get the requisite rupee funds. This has the effect of helping rupee appreciate in the spot while weakening it in the forward market

A liquidity crunch therefore, which continuous hikes in CRR inevitably help create, increases demand for rupee vis-à-vis the foreign currency, $. So generally the immediate effect of such a move would be to help rupee to appreciate in the spot market. The degree and extent of the rupee appreciation however ,would depend on the relative demand for $.In a scenario where FII’s are pulling out, naturally the rupee’ gains are checked by a simultaneous demand for dollar.

Macroeconomic impacts

A one off hike in the key variables is not likely to cause the below, but a steady course of hikes will mean a great deal of strain on the economy in the following ways:

Margins of corporate as a whole would come down sharply particularly highly leveraged companies. Unlike big corporates which can fall back in internal accruals and cash surpluses, small and medium scale industries which are wholly dependant on bank credit will be severely hit.

Capital expenditure projects and other expansion plans may get deferred, which could ultimately impact employment generation.

Consumption of manufacturing inputs and end use of life style products is likely to take hit.

Its impact on inflation is likely to be indirect , working its way through slower growth.

Much of the inflation experienced is either due to global pressures as in the case of oil or serious supply side constraints ( food articles). Increases in CRR and repo are unlikely to check this because the transmission mechanism works its way through the demand and not the supply side

Real estate prices could witness a correction as home loans get dearer and default rate increases.

As a final word the impact of these increases would help the rupee appreciate in the near term, especially if it is backed by crude sliding down. However, the long term impact would be to weaken the rupee as growth further moderates as the broader economy bears the brunt of steady hikes in borrowing costs. A case in point here is that the central bank is sadly targeting the WPI and not the more relevant Consumer Price Inflation, which continues to remain high and it would be interesting to see in the months ahead if monetary tightening manages to rein in the supply side phenomenon of inflation hitting the consumer.

Wednesday, July 30, 2008

Impact of Monetary tightening

Friday, July 25, 2008

OIL – Only In Longs??

With virtually every central banker and ruling political leader across the globe losing sleep over the vicious phenomenon of inflation and it’s seeming stubbornness never to subside, it seems – (or that’s what the charts say )…..that it just may be time to stop worrying about the biggest contributor of it, namely crude oil…..

So has OIL finally TOPPED??

Could seem like a million dollar question but recent price action gives us sufficient reason to believe that it has….at least for the time being.

As evidenced in the Chart above, there has been 2 consecutive trend line breaches coinciding with a reversal bar confirmation and a double top.

WE could in all probability witness a short covering rally in the next couple of days, that could potentially target anywhere between 132 to 135. There could be an extended spurt to 138 also. However if this recovery does not sustain above 138-140, the next leg of correction may be in the offing – a fall that could be targeting 105-110 levels.

Implications for our very own Indian Rupee…..

The rupee could retrace back to a 42.74 – 42.84 .If price action does not sustain above 42.85, the next round of correction could target anywhere between 41.25 and 41.50.

Friday, July 18, 2008

DEJA VU-2004

As the saying goes, History is a good teacher ‘coz unless you learn its lessons well when taught the first time …………it would repeat itself until you did!

Flash-Back to 2004……………...

The US was infact just coming out of a 1 year hiatus period after a series of rate cuts -courtesy The Fed, from 6.5% to 1% between 2000 and 2003.The theme, of course was quite different – it was the DOT Com bubble which popped numerically on March 10, 2000 when the NASDAQ Composite index peaked at 5,048.62 more than double its value just a year before.

June ‘04 witnessed a significant shift in monetary policy – a steady course of 25 bps hike to the benchmark rate that was to follow for the next 2 years.

And as the year progressed to encounter the verdict on the next Presidential vote, the dollar went on a tailspin, seemingly into a bottomless pit…… Almost every other news clip and financial journal had something to say on the dollar’s fate. Not to forget investors and financial experts across the globe railing and ranting over what seemed to be a possible “DEATH” for the dollar. Analysts and currency strategists were no exception, calling for a one-sided decline in the reserve currency right into the whole of 2005. Infact you would have risked being called a full-fledged fool if you’d even thought of being a dollar bull………

…………..and what was interesting in this entire episode was that the euro and sterling went galloping to new highs with each passing day, despite a slew of negative economic data being released from the respective regions.

And as everyone knows today, 2005 is recorded as a year which saw probably one of the best bull runs for the greenback.

So what lessons do we take home as we step back into the current reality of 2008………..A year that just witnessed a series of aggressive rate cuts by the Fed - the problem though was the housing bubble burst and the resultant Sub Prime crises. But then again, we have the 56th Presidential elections around the corner AND the dollar plunging to new lows, this time particularly against the commodity currencies apart from the euro. Take a closer look at the UK and Euro Zone data and you will find that there is virtually nothing to cheer about these economies from a growth perspective.

So if History has taught the right lessons we may have some very valuable pointers going forward. We could probably see the dollar being driven down further in the run up to the elections which would be the final leg of the fall, effectively paving the way for the next course of rally to maybe a 1.45 to a euro and 1.83 to a pound in 2009.Commodites is most likely to follow suit as a massive unwinding is likely to set in 2009 after an immediate final rally.

WELL Worth the Flashback…..huh?? .......Well,that’s again for time to tell!

Thursday, July 10, 2008

A study of Rupee in relation to FII flows - 17th June 2008

A closer look reveals an interesting relationship in that 67% of the times over the past 53 months, whenever FII net flows turned negative to the tune of Rs 3000 crs or more in a single month; it has had the effect of hitting sentiment for the domestic currency and has spurred a default dollar rally.

There seems to be a steady pattern even in this relationship:

- the first trigger is usually caused by FII outflows which takes the market by surprise and leads to heightened volatility leading to a sharp spurt in the dollar in a very short time span.

- This is followed by a continuation of the trend for a few months (anywhere between 3 and 6 months) wherein if FII flows stage a comeback to positive territory and remain positive for about 3-4 months in a stretch, then the dollar momentum wears out and gives way to rupee rise.

However in all of the above cases, the extent of rupee weakness in the face of FII outflows is governed by the principle trend of the overall price action. For instance, when price staged a break in the multi month uptrend of the $ in March 2007, an outflow of Rs 17000 crs in Jan 2008 coincided with the rupee hitting a high of 39.37(which is an exception to the above “normal” rupee response).

An R-Squared of 1.0 indicates a perfect fit. Statistically the equation implicitly points to certain unexplained extraneous variable(s).This would typically relate to the jitters following the surprise outcome in the General Elections, trade deficit worries in the face of a dip in inflows and to a large extent sentiment, amongst others.

An R-Squared of 1.0 indicates a perfect fit. Statistically the equation implicitly points to certain unexplained extraneous variable(s).This would typically relate to the jitters following the surprise outcome in the General Elections, trade deficit worries in the face of a dip in inflows and to a large extent sentiment, amongst others. The final step in the above analysis was to plot varying values of the independent variable, namely FII flows and run a simulation based on the fitted regression equation and compare it against the actual rupee movement which was registered in the months, post August 2004.As can be seen in Chart 4, the variation has been quite substantial, as the fitted projection mostly overestimated the $

The final step in the above analysis was to plot varying values of the independent variable, namely FII flows and run a simulation based on the fitted regression equation and compare it against the actual rupee movement which was registered in the months, post August 2004.As can be seen in Chart 4, the variation has been quite substantial, as the fitted projection mostly overestimated the $  Chart 6

Chart 6- Here again there is a huge unexplained component and surprisingly oil doesn’t feature in the list as it in fact declined 19% in the same period.

Chart 7

- However despite R square at .01, the actual rate that prevailed post December 2005 nearly coincided with the fitted projected curve after a lag of 3 months.

3)FEBRUARY 2006 to SEPTEMBER

Chart 9

Chart 9

Chart 12

Chart 12

Chart 13

However since the negative slope has historically resulted in an overestimation of $ rates, there is every likelihood that the projected rates could possess an element of deviation. From the above projected, on the upside 43.71 would be a formidable barrier and likewise 40.68 on the downside in the event of rupee appreciation

However since the negative slope has historically resulted in an overestimation of $ rates, there is every likelihood that the projected rates could possess an element of deviation. From the above projected, on the upside 43.71 would be a formidable barrier and likewise 40.68 on the downside in the event of rupee appreciationA Study of the Rupee vis-à-vis the Black Gold -27th May 2008

The chart 1 indicates that the overall secular trend of oil has been to the upside. It has been a steady bull run that was interspersed by short periods of consolidation.

The chart 1 indicates that the overall secular trend of oil has been to the upside. It has been a steady bull run that was interspersed by short periods of consolidation.Medium term: Corrective dips would find key supports at 100-115.So long as price action is contained above the pink line, dips would provide bidding opportunities to take the rally forward.

Long term perspective: Real estate, equities and commodities were the three major asset classes that simultaneously witnessed swift appreciation on cheap money and easy liquidity (spurred by the Fed cutting rates to 1% that existed until June 2004).Of which housing and equities have taken a reasonably decent round of correction in recent times. Commodities is the only asset class which is yet to undergo a significant correction. This is expected to occur when the Fed stops its easing stance and switches to a tightening mode on account of inflationary pressures which will most certainly come to haunt the US economy possibly in 2009 (fallout of rates being aggressive cut together with commodity led inflation)

Thus in short, it is still too premature to call it a top for the Bull Run in oil. Having said that, a temporary top may be in place to set in motion a correction to the above mentioned support levels .However for a confirmed trend reversal, 85 would need to be breached convincingly.

The rupee in contrast has witnessed a more convoluted price action which has been a combination of prolonged periods of consolidation and swift reversals .One noteworthy characteristic of the rupee’s movement is that volatility is greatest at turning points and diminishes as the trend becomes established.

The rupee in contrast has witnessed a more convoluted price action which has been a combination of prolonged periods of consolidation and swift reversals .One noteworthy characteristic of the rupee’s movement is that volatility is greatest at turning points and diminishes as the trend becomes established.Chart 2 reveals four significant depreciation spells that have occurred between 2004 and now.

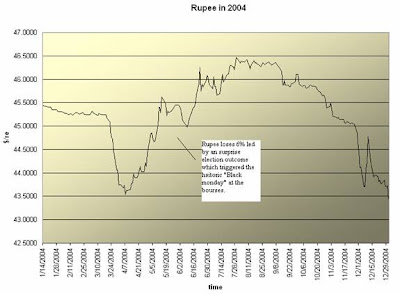

April-August 2004 : The Rupee depreciated from 43.30 to 46.50, an approximate 7.4% fall during this phase, the main trigger being the surprise outcome of the Indian general assembly elections at a time when global risk aversion was also generally high. This had resulted in a major sell-off in Indian equity markets. Oil prices moved from $34 to $47.

September - Dec 2005: Despite a relatively stable global risk environment, the rupee spurted from 43.50 to 46.50 levels. There was no single reason but a host of factors namely, scant portfolio flows amidst current account deficit, opening NDF arbitrage, trigger of overly-leveraged structures. Interestingly, oil prices declined from $70 to around $57 during the same period.

February- September 2006: This period saw the onset of the commodity market boom, which fanned a huge spike in global risk aversion over fears of rising global inflation and impact on global growth which led to a huge sell-off in emerging market equities. The dollar notched up approximately 6.8% gains as it briefly kissed the 47 mark .Oil prices surged from $58 to about $ 77 in this period.

February- September 2006: This period saw the onset of the commodity market boom, which fanned a huge spike in global risk aversion over fears of rising global inflation and impact on global growth which led to a huge sell-off in emerging market equities. The dollar notched up approximately 6.8% gains as it briefly kissed the 47 mark .Oil prices surged from $58 to about $ 77 in this period.The credit crisis and fears over a severe recession in the US economy had resulted in a major spike in global risk aversion at the start of the calendar year. 30% of the market capitalization was shaved off in equity markets in a span of days. Since then portfolio flows have failed to pick up even as signs of retreating global risk aversion has been noticed. There has also been a perceptible decline in announcements of fresh private equity deals. So, in a nutshell, the volume of cross-border capital flows has dwindled over the last few months. Unabated rise in global oil prices did trigger in panic buying of dollars. It is however interesting to note from the above chart that the rupee maintained its poise under 40 when oil prices initially climbed to 119.5. The rupee’s rapid fall was when oil climbed yet again past 119.5 levels.

Even when the rupee staged possibly its best ever rally from April 2007 until sometime back gaining a terrific 11% against the dollar, oil continued its steady upward march rising approximately 67% from $59 to $100, posting thereby a clear negative correlation. This period also witnessed a copious inflow into the capital markets, which to a large extent determined the rupee’s fortunes.

Even when the rupee staged possibly its best ever rally from April 2007 until sometime back gaining a terrific 11% against the dollar, oil continued its steady upward march rising approximately 67% from $59 to $100, posting thereby a clear negative correlation. This period also witnessed a copious inflow into the capital markets, which to a large extent determined the rupee’s fortunes.The rupee’s recent behavior can be seen as a lagged response to oil prices generally exhibiting an upward climb in the past several months, it can be seen that markets have responded differently to apparently the same variable.

Going forward...

As noted earlier, oil could witness a correction towards 100-115 levels, which could be accompanied by the dollar slipping towards the 41.50/75 territory. Performance of the domestic bourses in relation to FII flows will also set the near term direction for the domestic currency.

Wednesday, July 9, 2008

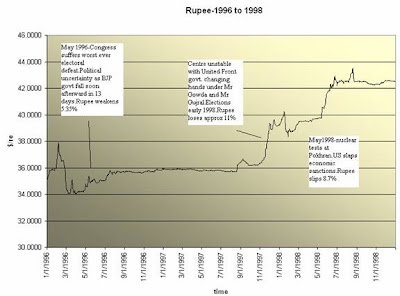

Elections and Rupee

However the actual results proved the anti-incumbency factor at work. The stock markets (Bombay Stock Exchange) fell in the week prior to the announcement of the results due to fears of an unstable coalition. As soon as counting began, however, it became clear that the Congress coalition was headed for a sizeable lead over the NDA and the market surged, only to crash the following day when the left parties, whose support would be required for government formation, announced that it was their intention to do away with the disinvestment ministry.

Despite the prime architect of the economic liberalization of the early 1990s leading the coalition, the fear that reforms would take a back seat purely because of the Left-connection stood to haunt the markets and rupee remained weak close to 6 months before it recouped its losses on the back of FII’s evincing renewed interest in India’s fundamentals.

As a final word, history is testimony to the unanimous and consistent response of the Indian currency during the election/post-election periods. Odds are that the rupee could behave in a similar fashion and therefore we could expect heightened volatility in 2009 or earlier if political conditions warrant.

Sensex-Technical Analysis

The chart above indicates that Sensex has corrected very well, retracing exactly to test the 61.8% Fibo level from 8000 to 21000. 61.8% Fibo is an extremely critical retracement level, as most corrective waves of bull runs in financial markets form a bottom at this key scientific level. Having said that, if price remains under this 61.8% (in our case 12800) then the implication would be that price could retrace 100% - meaning if SENSEX remains under 12600-12800 then a fall to the start of the bull run namely 8000-8500 would seem increasingly probable. However immediately a good recovery may be underway towards the falling trend line resistance at 15000-15500 (see chart below).

In the forthcoming days, it would be interesting to see if the recovery manages to break above the falling trend line, because failure to do so would spark the first signal that a deeper downside attack awaits the Sensex.