RBI today stuck to its tightening stance and hiked the Repo rate from 8.5% to 9%

It also tinkered with the CRR, hiking it by 25 bps from 8.75% to 9%.

Repo rate essentially forms the upper ceiling of the Liquidity adjustment Facility and constitutes the rate at which RBI would be willing to lend funds to banks .In short, it is the rate at which RBI injects liquidity into the system.

Given a background of tight liquidity as evidenced by virtually no bids on the Reverse Repo window, call rates close to 9% and inflation just a tad below 12%, this move of the central bank to further increase borrowing costs of banks can be seen as a measure to restrict the lending capacity of banks and thereby rein in credit off take.

CRR on the other hand measures the ratio of time and demand deposits that banks would compulsorily need to park with the Central bank. A hike in the Reserve requirements would affect the potential of the banking system to create transaction deposits thereby resulting in reduced money creation and, in turn, in reduced economic activity.

While seen as an effort to preempt any further build up of inflationary pressures, the above increases would have the effect of pressuring profit margins of banks and slowing growth in the forthcoming quarters.

Generally when the key monetary variables are raised, it has the effect of increasing forward premiums from the following standpoints:

- interest rate differential between US and India widens in favour of the latter and therefore the former nation’s (US) currency tends to gain in the forward market to eliminate any interest rate arbitrage today.

- Domestic bond yields rises which gets reflected in the forward premia.

- Banks in order to meet the increased margin requirements will need to attract more deposits - a proposition that is difficult in the very near term .Therefore banks tend to indulge in sell-buy swaps in the foreign exchange market wherein they sell dollars in the spot market and take an offsetting position by buying dollars in the forward market to get the requisite rupee funds. This has the effect of helping rupee appreciate in the spot while weakening it in the forward market

A liquidity crunch therefore, which continuous hikes in CRR inevitably help create, increases demand for rupee vis-à-vis the foreign currency, $. So generally the immediate effect of such a move would be to help rupee to appreciate in the spot market. The degree and extent of the rupee appreciation however ,would depend on the relative demand for $.In a scenario where FII’s are pulling out, naturally the rupee’ gains are checked by a simultaneous demand for dollar.

Macroeconomic impacts

A one off hike in the key variables is not likely to cause the below, but a steady course of hikes will mean a great deal of strain on the economy in the following ways:

Margins of corporate as a whole would come down sharply particularly highly leveraged companies. Unlike big corporates which can fall back in internal accruals and cash surpluses, small and medium scale industries which are wholly dependant on bank credit will be severely hit.

Capital expenditure projects and other expansion plans may get deferred, which could ultimately impact employment generation.

Consumption of manufacturing inputs and end use of life style products is likely to take hit.

Its impact on inflation is likely to be indirect , working its way through slower growth.

Much of the inflation experienced is either due to global pressures as in the case of oil or serious supply side constraints ( food articles). Increases in CRR and repo are unlikely to check this because the transmission mechanism works its way through the demand and not the supply side

Real estate prices could witness a correction as home loans get dearer and default rate increases.

As a final word the impact of these increases would help the rupee appreciate in the near term, especially if it is backed by crude sliding down. However, the long term impact would be to weaken the rupee as growth further moderates as the broader economy bears the brunt of steady hikes in borrowing costs. A case in point here is that the central bank is sadly targeting the WPI and not the more relevant Consumer Price Inflation, which continues to remain high and it would be interesting to see in the months ahead if monetary tightening manages to rein in the supply side phenomenon of inflation hitting the consumer.

An R-Squared of 1.0 indicates a perfect fit. Statistically the equation implicitly points to certain unexplained extraneous variable(s).This would typically relate to the jitters following the surprise outcome in the General Elections, trade deficit worries in the face of a dip in inflows and to a large extent sentiment, amongst others.

An R-Squared of 1.0 indicates a perfect fit. Statistically the equation implicitly points to certain unexplained extraneous variable(s).This would typically relate to the jitters following the surprise outcome in the General Elections, trade deficit worries in the face of a dip in inflows and to a large extent sentiment, amongst others. The final step in the above analysis was to plot varying values of the independent variable, namely FII flows and run a simulation based on the fitted regression equation and compare it against the actual rupee movement which was registered in the months, post August 2004.As can be seen in Chart 4, the variation has been quite substantial, as the fitted projection mostly overestimated the $

The final step in the above analysis was to plot varying values of the independent variable, namely FII flows and run a simulation based on the fitted regression equation and compare it against the actual rupee movement which was registered in the months, post August 2004.As can be seen in Chart 4, the variation has been quite substantial, as the fitted projection mostly overestimated the $

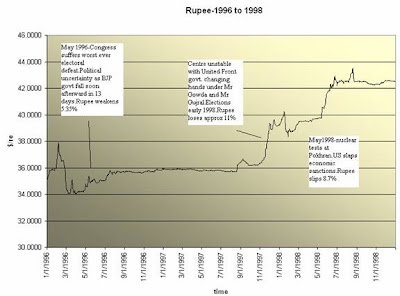

Chart 9

Chart 9

Chart 12

Chart 12