2009 may finally be the year when world over- governments, policymakers, central bankers may actually stop talking about recession….and begin their talk and acknowledgement of the repeat of the nineteen thirties horror of the Great depression.For one, it seems clear that a large majority of the “crowd” believe that the second half of 2009 may actually witness some recovery in the global scenario. I beg to differ on this for the simple reason that, what is presently unfolding is very much looking like pieces perfecting fitting into the deflation jigsaw puzzle-atleast from a theoretical perspective.

While I hate to be a prophetess of doom, the simple truth is that none of the central banks- not even the Fed would be able to stave off a depression style free fall of the global economy.

I base my argument on two very simple indicators for the US, which though short term in nature could be vital from a long term forecasting sense. The consumer spending and the manufacturing ISM juxtaposed against the rate cutting cycle by the Fed.

Chart 1

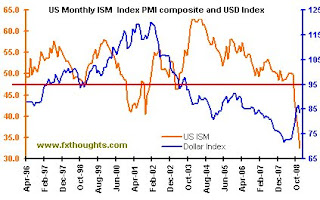

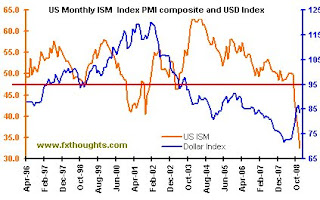

Core retail sales is seen as a proxy for consumer spending and ISM for the general health of the manufacturing sector. Looking at graph 1, core retail sales have steeply plunged of late. Moreover the ISM figures in graph 2 also portray a similar trend (see red curve).

Core retail sales is seen as a proxy for consumer spending and ISM for the general health of the manufacturing sector. Looking at graph 1, core retail sales have steeply plunged of late. Moreover the ISM figures in graph 2 also portray a similar trend (see red curve).Chart 2

This is pretty much pointing to a free fall in the US , the magnitude of which becomes more striking when seen against the monetary easing policy of the Fed(graph 3)(see orange line).Clearly the reduction in interest rates which began in Aug-Sept 2007 has not been able to either induce the consumer to spend or the manufacturing industries to expand or engage in asset creating investment spending. Infact the worrying feature is that the fall in both the indicators under study becomes sharper with larger doses of interest rate cuts. Now, this is clearly not a good sign because it to some extent underscores the ineffectiveness or insufficiency of monetary policy in immediately dealing with an economic crisis of this proportion.

Chart 3

Generally, monetary policy instruments are more effective during periods of inflation and gets more redundant when seen in isolation during deflationary phases. This is where Keynesian recommended fiscal tools-deficit spending become a relevant complementary policy measure.

Infact most central bankers across the globe contend that the best way to deal with deflation is to do everything possible to avoid it in the first place. Because once into it, it becomes virtually impossible to tackle the whole phenomenon, which is probably the reason why many of them shy away from explicitly acknowledging its real presence.

Ben Bernanke is particularly known for this as he has expressed in several of his speeches that deflation is “not a concern” to him as The Fed can never really run out of arsenal. To put it plainly, this implies that the Fed could print as much money to buy as many bonds needed to lower interest rates to a desired level. If that wasn't enough to cause inflation, the Fed in theory could start printing cash and buy other assets (homes, equities, etc) and even physical goods until the Fed held so much, that scarcity drove prices to rise. It is this idea that probably gave him the name of “Helicopter Ben” for his premise that the Fed could just toss cash from a helicopter to drive inflation.

Deflation seemingly is a paradox as a persistent decrease in price level which it signifies, could be nothing short of a boon for an individual who holds cash, coz he finds the purchasing power of his holding rise with a fall in prices. But from a macro level, a sustained decline in prices can be damaging to the economy as a whole, as it tends to lead to a vicious cycle of economic contraction as everyone begin’s to postpone spending decisions on the expectation of further price declines.

Probing into the potential causative agents, deflation could mean any of the following:

- a pure monetary phenomenon caused by a reduction in money supply

- the above could be extended to include a phenomenon resulting from a squeeze in credit.

- Deflation could be a supply side function

- And lastly could be demand led.

The first could be tackled by the popular monetarist idea of simply printing notes to inflate money supply.

The second is more severe - as in this case even an exhaustive printing and injection of liquidity by the central bank may be rendered futile if bank’s willingness to lend is not forthcoming. This unfortunately is the case presently, evidenced by interbank spreads remaining at high levels for a long time despite significant cuts in the overnight Fed Funds Rate (FFR).

The third type of deflation is a positive variant as it tends to be selective and concentrated on certain services/goods , mostly resulting from productivity gains or technology development .eg: Cheap labour in developing economies has helped reduce overall production costs to developed countries; cheap manufactured goods produced by China has helped the US enjoy relatively lower levels of inflation etc.

The fourth is an extremely serious condition – severity being a function of the % contribution of aggregate demand (consumer+ investment demand) to the total GDP.

While the picture painted is quite grim, there is still some hope for there is a bull market awaiting in the world of finance –something more simple than equities or debt – which in my guess is simply Cash. Because typically in a scenario of price increases, purchasing power of cash falls which drives people to invest to get a return to compensate for inflation; The opposite should hold true during deflation, for simply holding cash will generate a risk free return as cash will have a greater value at a future point in time than today when prices fall.

If this be the case, holders of cash are likely to be the biggest gainers and to some extent this in itself could prevent a faster recovery ‘coz people will begin to hoard cash (banks, consumers, corporates) which will have its linkage effects of further depressing economic activity.

The severity may also be attributed to the fact that merely pumping in cash (Fed) need not necessarily drive consumers & firms to spend or banks to lend .So basically more than a monetary phenomenon it is to do with primarily with human emotions-which is defined by the willingness to spend or lend as the case maybe backed by the critical levels of confidence and expectation-which is why my opening lines begin with the hypothesis that the fed cannot possibly halt an ensuing depression

Having said that, the implication for the dollar is far more complicated to envisage as it seldom responds in a logical manner and totally becomes a function of speculative positioning. As far as I can see the dollar is bound to eventually lose its “safe haven” shield .Particularly when authorities begin to more explicitly acknowledge the presence of deflation, markets are likely to factor this by punishing the dollar. However the dollar scenario could again play out differentially with respect to different currencies

Rupee – 48.80-49 is the key territory to be watched .Sustained trading above this could put the 50+scenario back in sight. As against this a break below 46.70 could open the gates for a rush of dollar sales towards 44.15.

Pound: Expecting a major retracement in the pound towards 1.66 in the New year.

Euro: outlook more clouded in the case of the European major. There is a likelihood that if it manages to sustain above 1.3880 we could see a shoot back toward 1.48 before we see the euro possibly tumbling back again to under 1.20 as the European region is likely to encounter greater challenges in 2009

Core retail sales is seen as a proxy for consumer spending and ISM for the general health of the manufacturing sector. Looking at graph 1, core retail sales have steeply plunged of late. Moreover the ISM figures in graph 2 also portray a similar trend (see red curve).

Core retail sales is seen as a proxy for consumer spending and ISM for the general health of the manufacturing sector. Looking at graph 1, core retail sales have steeply plunged of late. Moreover the ISM figures in graph 2 also portray a similar trend (see red curve).

No comments:

Post a Comment