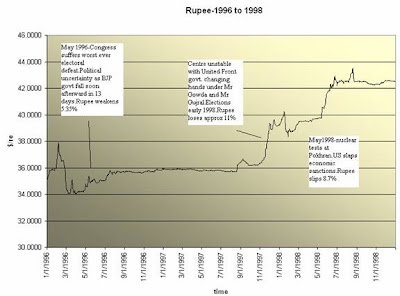

The period post the onslaught of economic reforms was plagued by a lot of political uncertainty and 1996-98 was particularly significant in this respect. It’s pretty evident from the Chart above that markets have always been averse to political uncertainty and the rupee by and large has weakened in the face of elections, political stalemates and surprise outcomes. Much of it is spurred by investors buying in the foreign reserve currency as a measure of safety till more clarity is seen in the domestic front. In fact the first time that the domestic currency breached past the psychological 40 level was during a challenging political environment.

The last year of the mlillenium proved to be equally volaile in that it was not only marred by political upheaval but hostilities with India's historic neighbour became more pronounced The 1999 Lok Sabha election is of historical importance as it was the first time a united front of parties managed to attain a majority and formed a government that lasted a full term of five years, thus ending a period of perceived political instability at the centre that was marked by three general elections held in as many years.

Most analysts believed the NDA would win the elections; this assessment was also supported by opinion polls. The party was supposed to have been riding on a wave of the so-called "feel good factor", typified by its promotional campaign "India Shining"

However the actual results proved the anti-incumbency factor at work. The stock markets (Bombay Stock Exchange) fell in the week prior to the announcement of the results due to fears of an unstable coalition. As soon as counting began, however, it became clear that the Congress coalition was headed for a sizeable lead over the NDA and the market surged, only to crash the following day when the left parties, whose support would be required for government formation, announced that it was their intention to do away with the disinvestment ministry.

Despite the prime architect of the economic liberalization of the early 1990s leading the coalition, the fear that reforms would take a back seat purely because of the Left-connection stood to haunt the markets and rupee remained weak close to 6 months before it recouped its losses on the back of FII’s evincing renewed interest in India’s fundamentals.

As a final word, history is testimony to the unanimous and consistent response of the Indian currency during the election/post-election periods. Odds are that the rupee could behave in a similar fashion and therefore we could expect heightened volatility in 2009 or earlier if political conditions warrant.

However the actual results proved the anti-incumbency factor at work. The stock markets (Bombay Stock Exchange) fell in the week prior to the announcement of the results due to fears of an unstable coalition. As soon as counting began, however, it became clear that the Congress coalition was headed for a sizeable lead over the NDA and the market surged, only to crash the following day when the left parties, whose support would be required for government formation, announced that it was their intention to do away with the disinvestment ministry.

Despite the prime architect of the economic liberalization of the early 1990s leading the coalition, the fear that reforms would take a back seat purely because of the Left-connection stood to haunt the markets and rupee remained weak close to 6 months before it recouped its losses on the back of FII’s evincing renewed interest in India’s fundamentals.

As a final word, history is testimony to the unanimous and consistent response of the Indian currency during the election/post-election periods. Odds are that the rupee could behave in a similar fashion and therefore we could expect heightened volatility in 2009 or earlier if political conditions warrant.

No comments:

Post a Comment